It’s no secret that finance professionals spend countless hours processing transactions, going back and forth on approval requests that lack key information, and wondering who spent what and when.

As if their cups aren’t already overflowing.

Accounting and financial management are among the most demanding professional areas, in terms of job-related pressure and stress. Overseeing the daily flow of expenses across an organization requires patience, smarts, and stamina.

Finance professionals aren’t just championing complicated math—they’re staying on top of revolving international financial standards, floating exchange rates, various spreadsheets controlled by multiple stakeholders, and strategic executive decisions with lightning-fast due dates.

Do you ever feel like your finance department is missing a real process? Are you getting feedback that your company’s approvals process has too many steps? Hint: it probably does.

What if we told you that you could get real-time visibility into financial processes down to individual transactions? What if everything pertaining to finance could be consolidated to one place, so that you could keep track of where money was coming in and out, without frantically searching spreadsheets, email chains, chat messages, and databases?

What if you could get finance back under control?

With Qntrl, finance professionals gain visibility, automation, and control of all finance operations. Expedite work efficiency and productivity, meet compliance standards, provide better transparency, and integrate processes with existing systems—all from the comfort of a single platform.

The perks of automating finance workflows

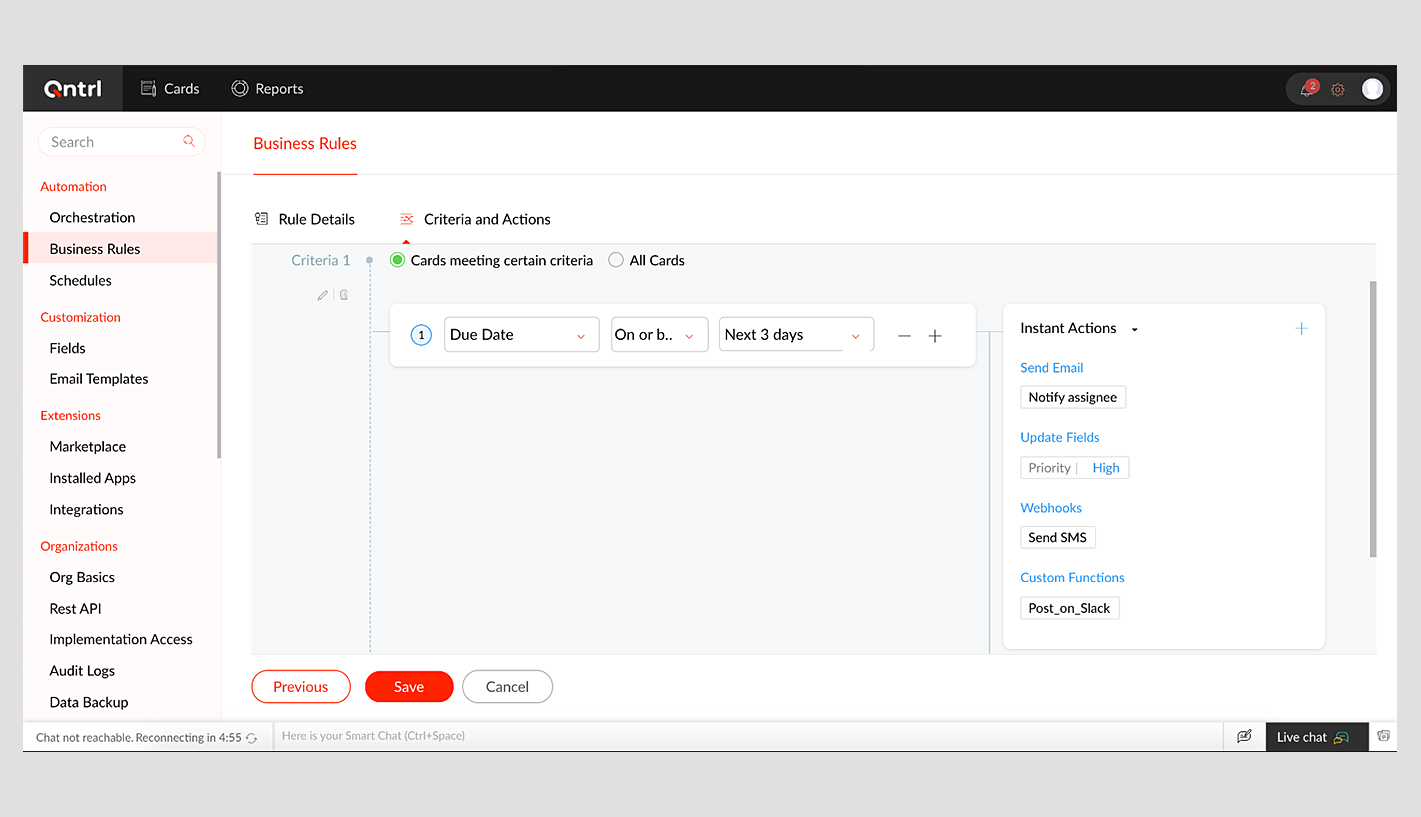

Automation helps you visualize all your current workflows, making it obvious where bottlenecks like approval inefficiencies lie. When your entire workflow is mapped digitally, you can make effective tweaks to existing processes to optimize workflows in a visually clear and comprehensive fashion.

Here are some immediate benefits:

Eliminate back and forth communication with automated claims and approval requests. This ensures that the information that should have already been provided in the original claim is mandatory, as part of the process.

Store all information and supporting documentation in a single place. This powerful digital format creates more effective and efficient communication and reporting.

Stay compliant and save time by enforcing and authenticating company policies within the finance department and at the source.

Make sure timelines are followed by automating escalation or exception reporting on items that are in danger of missing deadlines or causing organizational bottlenecks. This gives finance leaders and stakeholders a means to monitor work status anywhere within the department.

Stop chasing down signatures. No one enjoys sending (or receiving) nagging email follow-ups. Easily request the appropriate levels of sign-off by automating the approval chain with a sign-by date. Next, blast those tasks out to the responsible parties so they can keep themselves accountable.

Give finance leaders the control they need

Eliminating some redundant financial process management tasks frees up finance leaders to focus on big wins. Here’s what finance Orchestrators (that’s what we call our customers) can expect...

Total transparency

All payments and receivables will be logged transparently, with no room for error. You can track all requests in real time, quickly approve invoices and purchase requisitions, and ensure execution standards—all from a single hub. Finance leaders need complete visibility on cash flow, accounts, customers, and vendors. Qntrl helps them get there.

Outstanding operational KPIs

Key performance indicator measurement got you down? Use Qntrl to swiftly identify reasons for payment delays, analyze and shorten cycle times, and track employee performance. Take advantage of our report builder to generate and schedule your reports.

Data security and integrity at your fingertips

By automating financial processes, you can minimize or even eliminate manual errors. Since finance process management deals with sensitive data, you need the very best data security and integrity. Field access privileges, data encryption, and role-based access controls keep your sensitive information safe. That’s why Orchestrators choose Qntrl.

Automation

By breaking down a process and evaluating its flow, you can automate recurring rule-based processes. This is particularly useful in finance, as finance approvals tend to be both repetitive and predictable. Free up your time to focus on areas that need your human decision-making abilities and expertise.

Efficiency

Processes and procedures are more methodical and accurate when finance approvals aren’t bogged down with sprawling email threads and spreadsheets.

Scalability

If you’re not already using a workflow process management platform, you're probably starting to get worried about keeping up with the finances as your organization grows. With a standardized financial process, results will be consistent and streamlined, no matter how many people and tasks are added to the mix.

Things you should start automating right away

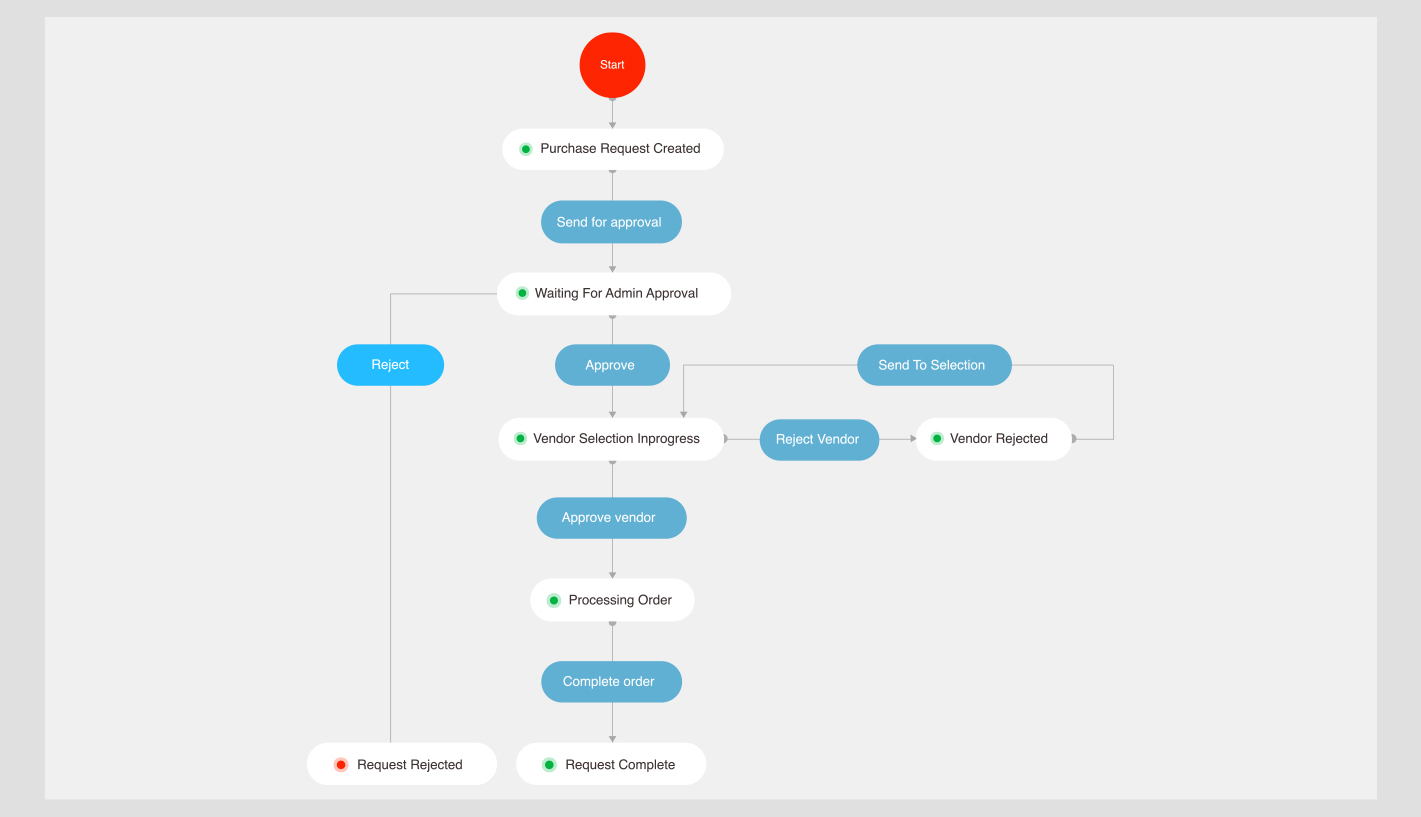

Purchase requests

Purchase request automation ensures the requester provides critical information and then routes the purchase orders to the appropriate person, without human intervention. Both initiators and approvers can look up orders whenever they need to. Finance leaders can track, monitor, and analyze business costs at the drop of a hat.

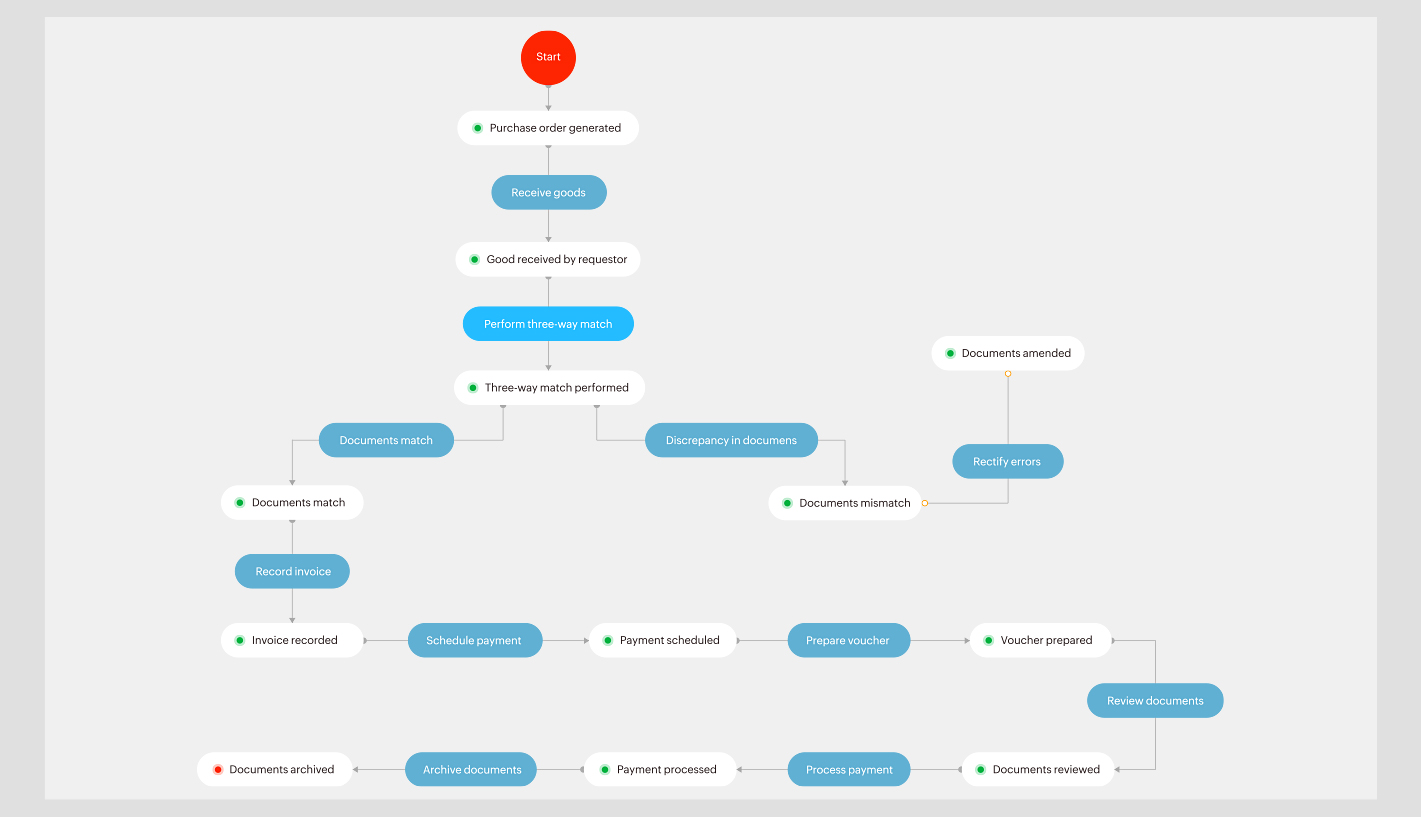

Accounts payable

Automating tasks, like recurring payments, periodic billing, and accounting, free up your finance team to do the things that require the most brainpower. Qntrl schedules billing, issues invoices, sends reminder letters for overdue payments, and even makes entries in your accounting tools. Boost revenue through accurate insights and streamline all the necessary processes.

Budget approvals

Ah, budget approvals. You hardly see anyone come out of a budget meeting with a smile on their face. The budget needs to be reviewed and signed off on by multiple stakeholders across multiple teams and varying hierarchy levels—and routine approvals are often held up because someone is too busy to sign off on an approval email.

With automation, though, rule-based decision-making steps up to the plate. Each approval request can be automatically routed to the right people, getting them to sign off without wasting their time on lengthy paperwork or reading through confusing email threads.

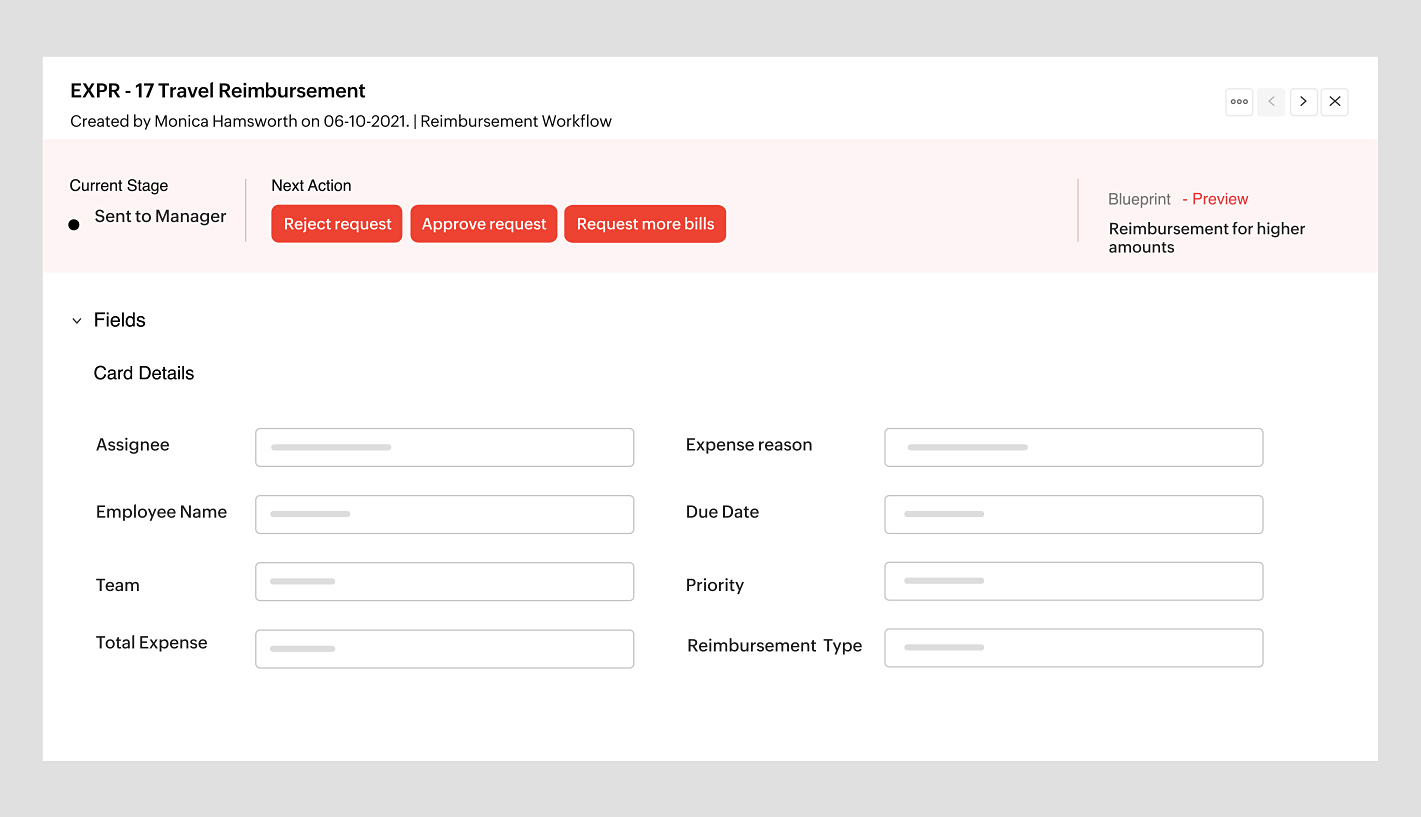

Travel requests

Does your team travel a lot? That means they’re likely raising business trip finance requests regarding flights, transportation, and food. Maintain a systematic flow for this information to reach the relevant managers for approval, and eliminate the tedious back and forth.

Expense management

Do you feel you’re out of the loop or have little control over the money the business spends on purchasing assets or employee-incurred expenses during business trips? Set up a spending policy and analyze spending patterns to identify areas of excessive spending, so you can cut back on unnecessary costs.

Take charge of your finance processes today

Do you want the power to accelerate low-budget requests automatically? Do you know the best way to route those high-dollar items and need the means to automate and control the approval process? Embed internal financial controls and make compliance an enabler for business performance, instead of a resource depleter. With Qntrl, finance professionals reap all the benefits of a cloud-based platform with the security you’d expect from an onsite system.

You’re already in charge. Now take control.